From Pampers to Dolce and Gabbana, from ASOS to Marks and Spencer there is a long list of Western brands that have made costly mistakes in China because they didn’t understand that Chinese consumers’ behaviour was not the same as Western consumers’ behaviour, or that social attitudes were different, or they didn’t pay attention to local cultural sensibilities.

These seem like obvious things that any company entering a new market should have understood and western companies have rightly been criticised in China and in the West for making these obvious mistakes. Yet Chinese companies are now making some of the same mistakes as they seek to enter and expand in Western markets. Not only do they fail to understand local consumers, but they are also failing to address a particular issue for Chinese brands, that is Consumers worldwide are still less likely to choose a Chinese brand in most categories. (Kantar Millward brown, 2019)

So, what are the issues? Firstly, over the past +15 years many consumers experience of Chinese products has been at the low price, low quality end of the market. To borrow an English phrase, at the ‘cheap and nasty’ end of the market, where as long as the price was low enough consumers would accept a low quality product. Although this is an outdated perception that doesn’t reflect the current day reality of Chinese design and manufacturing, it is nonetheless proving hard to shake off.

Firstly, this is because many Chinese companies are using lower price points as a means to gain market share. In theory, this shouldn’t be a problem. We live in age in which consumers are familiar with products and brands that originate from an ever wider range of different countries. They can easily access a wide range of information, and are more and more capable of assessing brand quality, and willing to select less well-known brands, when justified.

Yet Chinese brands are not benefitting because they are failing to give Western consumers other messages besides low price. Without other types of message the low price actually serves to reinforce the consumers existing perceptions of the brand. In the absence of relevant new information western consumers hold on to what they already know, or think they know about Chinese brands. Ultimately this will limit the brands ability to grow either by limiting the pool of customers who will buy its products, or by limiting their ability to charge higher prices, or a combination of both.

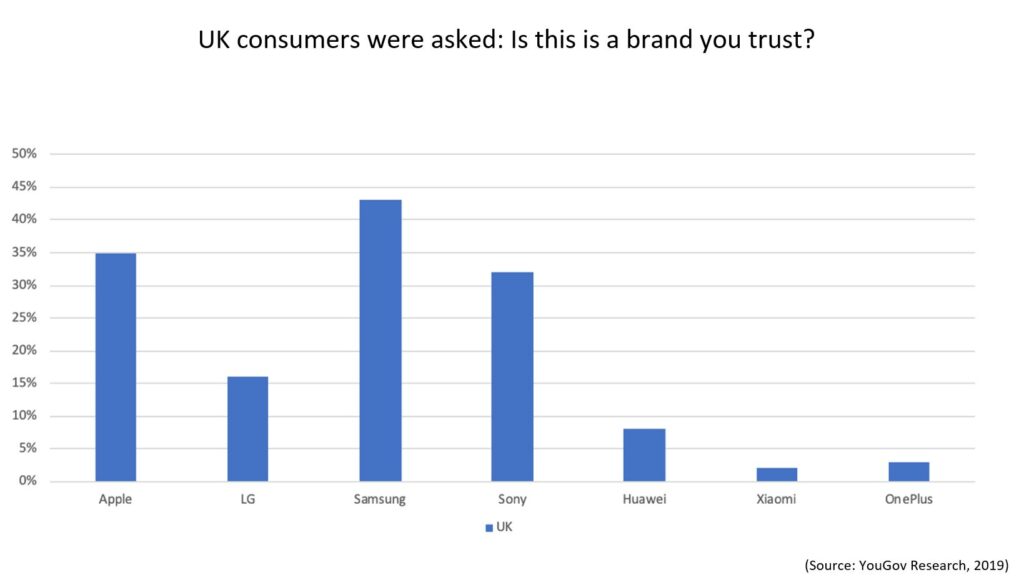

Secondly, this out of date perception about Chinese brands quality is compounded by another issue which is trust. This problem of trust varies from market to market, for example Spanish consumers are generally more willing to trust Chinese brands than UK or US consumers, but it is a fundamental challenge in every country and every category. For example, the UK Smartphone category where the quality of Chinese phones is equal to the competition, trust in the Chinese brands is significantly lower.

Although Huawei, is a special case because of the negative publicity surrounding its role in telecommunications infrastructure, the media stories about it contribute to the negative feelings about Chinese brands and trust. Many Chinese brands are not doing enough to understand how the issue of trust is influencing their target consumers and, therefore, are unable to provide new information that would change consumers perceptions and build trust.

In fact, sometimes a brands marketing adds to the problem. Xiaomi’s need to build awareness and trust in the UK was not helped by its first promotional activity in the UK which coincided with the opening of the store and attracted a large amount of negative media. This promotion offered its phones for the low price of just £1. This, obviously, is a bargain, and thousands of consumers were looking forward to buying at that price.

However, it was unclear how many phones were available for £1. In total only three phones were available during the promotion, but this detail was hidden in the terms and conditions. UK consumers were angry because they felt that they had been misled by Xiaomi. With news media, including the BBC, covering the story the marketing activity added to the lack of trust felt by UK consumers.

Xiaomi also tried a retail strategy. In November 2018 it opened its own large store at Westfield White City (London’s largest mall). The store sold a variety of Xiaomi products from mobile phones, TVs, smart kettles to electric scooters. Its pricing was very competitive and therefore affordable to a wide range of consumers. But there was nothing to make the store or its product stand out from the competition. It was the same as dozens of other stores. Nor did Xiaomi take the opportunity to tell new stories about itself and its products. As a result it has been unable to change consumer perceptions and build trust. It’s perhaps not surprising that the store was closed in March this year.

Two brands that have a deeper understand of the UK market and their consumers and are using this to create innovative ways to build trust and grow their volume and value of sales are Qingdao and Haier.

Qingdao operates in the imported and craft beers category and has a clear understanding of its target consumers and what they need to know. It’s marketing leverages Chinese cultural occasions, albeit in a Westernised form, to communicate and build trust with its consumers. The fact that its Chinese characteristics are actually the foundation of its success shows that with clear, consistent and open communications an apparent weakness cam become a strength.

A significant part of Haier’s strategy is focused on distribution. It has got its products listed in John Lewis. In the UK John Lewis is one of the UK’s oldest and most trusted retailers, known for the quality of its products, fair prices and excellent service. Haier products, and its brand, benefit from the association with John Lewis, as consumers feel that any product sold by John Lewis will be good quality, reliable and can be trusted.

Both these brands are succeeding because they understand the local market situation and what the local consumer needed to hear and see in order for them to form a new opinion about the brand. These brands are delivering actions and communications that enable consumers to trust the brand, so they feel comfortable to spend their hard earned money on it. A confident and open brand will understand its target consumers in a local market. It will tell them what they need to know, not what the brand thinks they should know, in order to create the necessary trust to help the brand gain traction and ‘win’ in a new market. As Haier CEO Zhang Ruihai has said: “Our philosophy: We always think we are wrong. We only take the customer’s need as right.”

For an in-depth understanding of the cultural and communications issue facing Chinese brands in the UK, and how to solve them, contact us.

Wesconnex is a unique marketing agency, established to help emerging Chinese brands grow faster and more efficiently in the UK. We provide localised Marketing Strategy & Planning, Ad Optimisation and Creation, and Content Marketing.